SoHo, NoHo & Nolita

The combined total of available in these three neighborhoods is 78 units which is in line with their reputation of always being a sellers market. And there are only 11 units in the pipeline.

60 of the available units are located at 100 Vandam, located in West SoHo.

These neighborhoods have a lot of co-ops, shops, and low buildings. This limits the number of new buildings that developers can construct here. When boutique buildings launch in this neighborhood, they sell out quickly. No projects exist in the pipeline for any of these neighborhoods.

Upper West Side & Lincoln Square

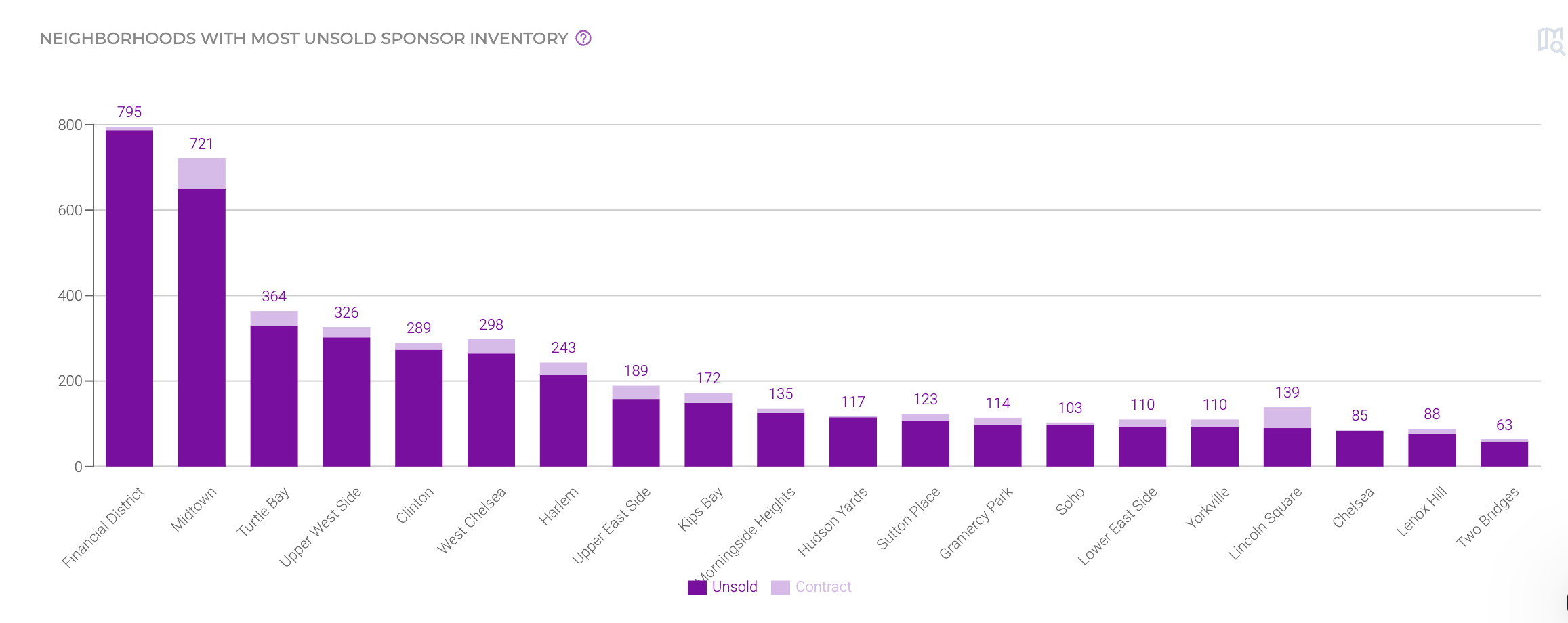

The Upper West Side has 362 unsold developer units available. The top 5 buildings that represent 75% of the unsold units are:

720 West End Ave (at W95th St) - 93 units

96+ Broadway - 83 units

50 W 66th St - 39 units

393 West End Avenue - 30 units

212 W 72nd St - 28 units

720 West End Avenue is a lovely new conversion of a historic Emery Roth building by architect Thomas Jul Hansen. Relatively low pricing at 720 WEA has attracted a lot of buyers.

50 West 66th Street, a new ultra luxury building by Extell, is similar to Central Park Tower and One 57. It has amazing Central Park views. A park view apartment here starts at about $20 million. There are also cheaper units without park views in the building.This building is special for the Upper West Side as it is a 70-story tower near Central Park West. This area gives residents easy access to famous museums and cultural sites.

Pipeline:

165 W 80th Street - 29 units

Turtle Bay, Kips Bay & Murray Hill

Turtle Bay and Kips Bay have 462 unsold units available, with 81% over the following four buildings:

Monogram NYC (E 47th St & Lexington) - 118 units

The Perrie (E 46th St & 2nd Ave) - 67 units

609 2nd Ave - 56 units

Eastlight (34th & 3rd Ave)- 53 units

The Willow - 53 units

Hendrix House (E 25th & 2nd Ave) - 25 units

Turtle Bay, Kips Bay, and Murray Hill are vibrant neighborhoods on Manhattan's East Side, each offering unique residential opportunities. Turtle Bay, stretching from East 43rd to East 53rd Streets between Lexington Avenue and the East River, is known for its proximity to the United Nations headquarters and numerous consulates, making it a hub for international diplomacy. Kips Bay, located south of Murray Hill down to 23rd Street, has seen a surge in new developments, including Eastlight and Hendrix House, adding modern luxury to the area . Murray Hill, nestled between these two, offers a blend of historic charm and contemporary living, with landmarks like the Morgan Library & Museum and a mix of brownstones and high-rises .

Pipeline

201 East 23rd St - 34 units

Greenwich Village & West Village

The Grand Dame of Downtown has always been the Village. Most Village real estate has landmark protection. Because of this, there are rarely new projects and it is perpetually a seller's market. Those projects that do get the green light are usually on the smaller side. The Village includes these two neighborhoods famous for historic townhomes and spacious single-family homes. It features charming streets, shops, and many dog parks, offering social spaces for dogs and outdoor areas for owners to relax and have fun.

On the outskirts of the neighborhood, there are two projects in the works that will provide much-needed housing in the neighborhood, albeit at high prices, especially for 80 Clarkson.

80 Clarkson St - 113 units

The Zeckendorfs, of 15 Central Park West fame, are building a 45-story luxury condo, offering ultra-luxury residences with panoramic views of the city and the Hudson River. It lies on the border of the West Village and West SoHo just North of the new Google Headquarters. This will be Downtown Manhattan's new development crown jewel.

The Village West, 525 Sixth Avenue - 68 units

On the edge of the West Village and Chelsea, The Village West will be spread over 13 floors and will sit at the corner of 14th Street and Sixth Avenue. The building features a distinctive red brick façade with rounded corners and stepped setbacks, complemented by rusted copper paneling.

Pipeline:

The Residences at W 9th St - 46 units

Upper East Side, Lenox Hill, Yorkville & Carnegie Hill

All of the Upper East Side (including Yorkville, Carnegie Hill, Lenox Hill) has only 204 new developer units available. The following 5 buildings make up 40% of the total units available:

255 E 77th St - 23 units

The 74 - 22 units

The Harper (W 86th St) - 22 units

Archive Lofts - 21 units

1289 Lexington - 13 units

Perhaps the most interesting of this bunch is 255 E77th Street, as it was designed by Robert A.M. Stern. As you can see, these are all boutique buildings, so not a lot of units in each. Whenever boutique buildings launch in this neighborhood, they sell out quickly.

The prime area of UES has many co-ops. This limits the number of new buildings that developers can construct. This is true mostly from Fifth Avenue to Lexington Avenue. New developments are usually in the more Eastern reaches of the neighborhood, from Third Avenue to the East River.

Pipeline:

The Strathmore (400 East 84th St) - 144 units (conversion)

175 E 82nd St - 72 units

1122 Madison Ave - 22 units

Hudson Yards

Hudson Yards stands as Manhattan’s newest neighborhood, a transformative development on the Far West Side built atop the Hudson Rail Yards, where trains from Penn Station are stored. This ambitious project, spearheaded by Related Companies and Oxford Properties Group, encompasses 28 acres and is recognized as the largest private real estate development in U.S. history

The area has rapidly evolved into a hub for major corporations, with office towers housing prominent firms such as BlackRock, Meta Platforms, Wells Fargo, and KKR. The development also features cultural landmarks like The Shed, luxury residences, and expansive public spaces.Beyond the core of Hudson Yards, the surrounding neighborhoods are experiencing significant growth.

Vita New York - 62 units

489 9th Ave - 59 units

35 Hudson Yards - 21 units

15 Hudson Yards - 16 units

35 Hudson Yards is the main building for Related Group’s Hudson Yards Project. This tower is an ultra-luxury building, like those on Billionaire’s Row. The Chairman Steve Roth lives in a penthouse. HBO’s Succession TV show features another penthouse unit in the building. 35 Hudson Yards has lowered its prices from the original plan. This change happened because they entered the market too late.

The building launched after selling most of 15 HY, and then Covid hit. They may have opened the building too early. Many corporate offices in Hudson Yards were not ready until recently. The initial offer plan price of 35 HY was a blended rate of $4,500 per square foot. Currently, most units are selling for much less, from $2,200 - $3,300 per square foot. This is a greater eal given the high-quality materials, excellent design, and overall quality. The interiors have the feeling of being in a Four Seasons Hotel.

Pipeline:

353 W 37th St - 115 units

439 W 36th St - 52 units

Tribeca

Tribeca is another neighborhood that is perpetually in a sellers market and currently has only has only 46 developer units available.

450 Washington Street - 16 units

Almost half of the available units are located at 450 Washington Street, a rental to condo conversion project by the Related Group. Sales which started in 2022, have been brisk. The building is now 75% sold.

A favorite among financiers, tech-savvy people, and entrepreneurs, Tribeca has become very popular. Artists' lofts have turned into condos, and celebrity-approved buildings have increased the area's appeal. Tribeca, like Park Slope in Brooklyn, provides a lively city life with cultural spots, parks, and nearby services. Residents love the public school district because Stuyvesant High School sits in Tribeca. And the Riverside Park along the Hudson River is very accessible.

The historic buildings and low-rise zoning rules in the neighborhood limit future development. However, some tall towers have appeared near the World Trade Center at the southern border.

Tribeca has a handful of buildings in the pipeline but nothing substantial (less than 80 units).

Pipeline:

65 Franklin (The Rebel) - 40 units

West Chelsea

While many people dream about living in the West Village, the housing stock makes it prohibitive, as it is mostly a low rise historic district full of townhomes. While this adds to the allure of the West Village, it does little for new development opportunities. West Chelsea is the next best thing. The proximity to the West Village and Hudson Yards is a key factor of the neighborhood’s popularity.

West Chelsea has 215 unsold units from developers. Seventy-four percent of these units are in two beautiful buildings, One High Line and The Cortland, along the Hudson River and close by each other.

One High Line - 68 units

Hxh Residences - 32 units

Linea - 23 units

Cortland - 19 units

One High Line, formerly known as The XI, reopened in September 2022 after a significant transformation. The development features two twisting limestone towers designed by architect Bjarke Ingels, situated along the Hudson River. Initially developed by HFZ Capital Group, the project faced financial difficulties and was acquired at auction by new developers Witkoff Group and Access Industries. Under their leadership, some unit prices were adjusted, leading to brisk sales activity.

Cortland, which launched sales in the previous year, is another masterpiece by architect Robert A.M. Stern. Stern has created some of the most luxurious buildings in New York City. These include 520 Park, 15 Central Park West, and 220 Central Park South. He also designed Superior Ink and 70 Vestry in the Village and Tribeca.

HxH Residences (517 W 29th) is a standout choice thanks to its prime location—just steps south of Hudson Yards and the High Line—keeping you at the heart of what now is one of Manhattan’s most dynamic new retail, dining, and transit hub. And, we expect the area to improve as the second phase is contemplated. What’s more, it offers relative value: condo units begin in the mid-$800K range—significantly more affordable than many newer developments nearby—while still delivering premium finishes and full-service amenities. Location, location, location!

These are some of the most interesting downtown projects right now. Once they sell out, developers will not start new projects in West Chelsea for a long time. Most of the lots have already been built on. West Chelsea is a mostly low rise luxury neighborhood along the High Line Park. It is home to well-paid workers from companies like KKR, Blackstone, and Morgan Stanley.

Pipeline

540 W 21st Street - 34 units.

This is one of the last remaining buildable lots along the Hudson River.

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)

START YOUR SEARCH NOW